Have you tired of using traditional tools for financial planning? Do you need a tool that can speed up your financial management without making any mistakes? Then, You are at the right content.

Because we are going to discuss the Top 5 AI tools for financial planning to become smart for effective planning and decision-making.

Fortunately, the advancement of technology has brought forth a plethora of AI tools that can aid individuals and businesses in navigating the complexities of financial planning. So, Let’s discuss the apps that offer convenience, accuracy, and insight without breaking the bank.

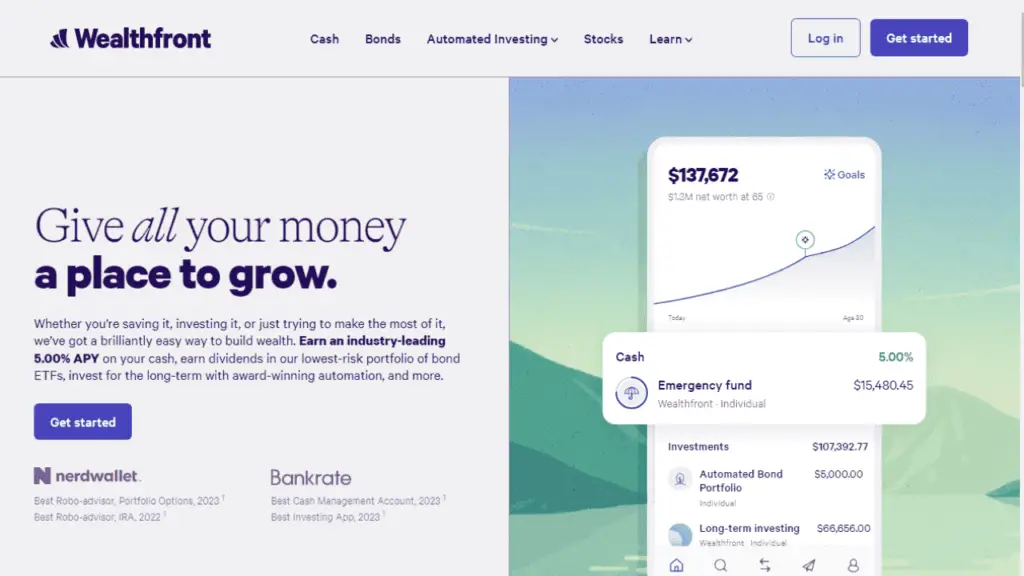

Wealthfront

Wealthfront is a leading AI-powered robo-advisor that offers automated investment management services. By using advanced artificial intelligence, Wealthfront creates personalized investment portfolios tailored to individual financial goals and risk tolerance.

With features such as tax-loss harvesting and automatic rebalancing, Wealthfront optimizes investment returns while minimizing tax liabilities. Additionally, its Path tool provides comprehensive financial planning insights, including retirement planning, college savings, and major purchase goals.

Empower

Empower is another prominent AI-driven financial planning platform that combines automated investing with personalized financial advisory services. Through its easy-to-understand dashboard, users can track their entire financial picture, including investments, retirement accounts, and expenses.

Personal Capital’s Retirement Planner uses AI algorithms to forecast retirement scenarios, check potential risks, and optimize savings strategies. Moreover, its Investment Checkup tool offers portfolio analysis and recommendations for improved diversification and performance.

Credit Karma

While primarily known for its credit monitoring services, Credit Karma also offers AI-driven financial tools for budgeting and planning. Its Credit Karma Money platform provides a high-yield savings account with no fees and early access to paychecks.

Furthermore, Credit Karma’s personalized recommendations help users identify opportunities to save money on loans, credit cards, and insurance policies. Through AI algorithms, Credit Karma analyzes spending patterns and offers insights to improve financial wellness.

Mint

Mint is a popular AI-powered budgeting app that offers comprehensive financial management solutions. By aggregating financial accounts, Mint provides a holistic view of income, expenses, and savings goals. Its AI algorithms categorize transactions and provide personalized budgeting recommendations based on spending habits.

Mint also offers bill tracking, credit score monitoring, and alerts for unusual account activity. With its easy-to-understand interface and actionable insights, Mint allows users to make informed financial decisions.

Albert

If you are looking for an AI-driven financial assistant that helps users manage your money effectively, then you can consider Albert. Because of its chat-based interface, Albert provides personalized recommendations for budgeting, saving, and investing. Its predictive algorithms analyze spending patterns and identify opportunities to save money or increase income.

Albert’s Genius feature offers actionable advice on various financial topics, such as debt reduction, retirement planning, and investment strategies. Moreover, Albert’s automated savings feature helps users build emergency funds and achieve their financial goals effortlessly.

Conclusion

Lastly, It’s time to end up our discussion on AI tools for Faninacinal planning. So, it’s your time to select one and use that. We have discussed all tools that offer individuals and businesses unprecedented access to advanced analytics, personalized recommendations, and automated solutions.

Whether it’s managing investments, optimizing budgets, or planning for retirement, these free AI tools empower users to take control of their financial futures with confidence and ease.

But If you are an individual then you can make smarter decisions, achieve your financial goals, and secure a brighter tomorrow.

Frequently Asked Questions

What is the role of AI in financial planning?

AI in financial planning involves the use of algorithms and data analysis to provide personalized investment advice, automate portfolio management, and optimize financial decision-making.

Are these AI tools suitable for beginners in finance?

Yes, many AI tools for financial planning are designed to cater to users of all experience levels, offering user-friendly interfaces, educational resources, and automated features to assist beginners in managing their finances effectively.

How secure are AI-powered financial planning platforms?

AI-powered financial planning platforms prioritize security measures such as encryption, multi-factor authentication, and fraud detection algorithms to safeguard users’ sensitive financial information and transactions.

Can AI tools replace human financial advisors?

While AI tools can provide valuable insights and automate certain aspects of financial planning, they typically complement rather than replace human financial advisors. Human advisors offer personalized guidance, emotional support, and strategic planning that AI tools may not fully replicate.

Do these AI tools require a minimum investment amount?

Many AI tools for financial planning offer low minimum investment requirements or allow users to get started with small amounts of money, making them accessible to a wide range of investors, including those with limited funds to invest.

Hi, We are a professional team about exploring the latest AI apps and tools. With a keen eye for innovation, we meticulously analyze AI tools to provide our readers with top-notch guides. Stay informed with our expert insights as we navigate the ever-evolving landscape of artificial intelligence applications.